Investing with the Midas touch 🏆

How high might gold prices go in 2025? Plus: Bond investments that won't leave a big tax bill.

In this issue

Gold is up more than 15% this year, while so many other investments are down. Tariff-related uncertainty, central bank purchases and higher forecasts from Wall Street analysts all play a role. But is gold really a safe-haven investment? The data isn’t clear.

Had a big tax bill from your investments in 2024? Tax-exempt bonds may be worth a look. But make sure you understand the risks, broker availability and tax rules about tax-exempt bond investments before you buy.

The first official estimate of U.S. GDP for Q1 2025 is due at the end of the month. Plus, many big tech stocks report earnings in April.

Investing in gold in 2025

We’re only three months into 2025, but it’s already shaping up to be a rough year for many investors. The S&P 500 index is down more than 4% for the year. Bitcoin is down more than 8%. Even many bond funds are flat for the year.

But gold has been a bright spot. The price of gold is up more than 15% so far this year. Here’s why, and what it means for investors.

What’s going on in the gold market this year?

Many of the largest investment banks, including J.P. Morgan, Goldman Sachs and Bank of America, have raised their gold price forecasts for 2025.

A mid-March note from J.P. Morgan forecasts a price as high as $3,200 per ounce by the end of the year. Goldman Sachs and Bank of America announced even more bullish gold outlooks last month, forecasting year-end prices of $3,300 and $3,350 per ounce, respectively.

All three banks cited global economic uncertainty related to the Trump administration’s tariff policies as a driver of demand for safe-haven assets such as gold.

J.P. Morgan and Goldman Sachs additionally expect the central banks of foreign countries to ramp up purchases of gold reserves due to the threat of sanctions, tariffs, and U.S. dollar volatility under the new administration.

Does gold belong in your portfolio?

Gold has outperformed the S&P 500 over the last 25 years, and some “lazy portfolios” (long-term-oriented model portfolios consisting of just a few index funds) recommend holding a small amount of gold for investment diversification purposes, such as the “Permanent Portfolio” popularized by investment advisor and author Harry Browne.

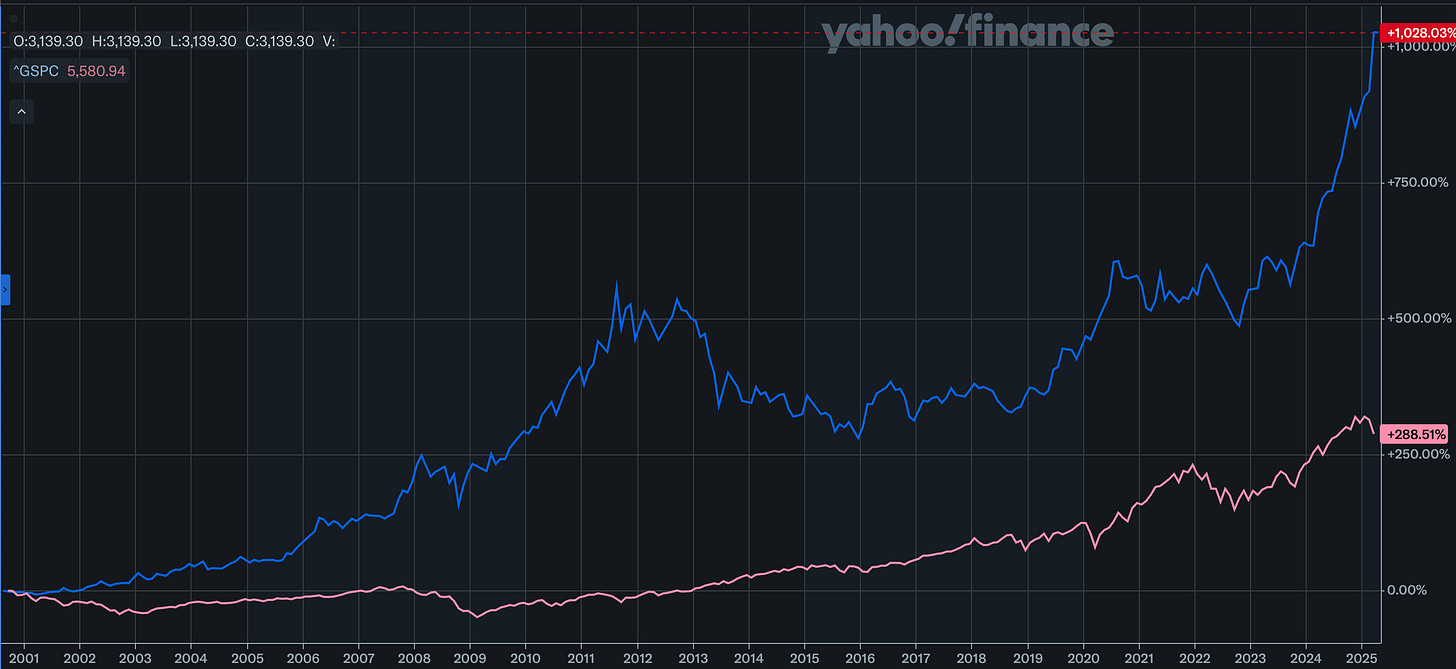

Proponents of gold investing sometimes claim that the metal’s price is uncorrelated to the stock market. But the chart below, which shows the price of gold futures in blue and the S&P 500 index in pink, casts some doubt on this idea.

Source: Yahoo Finance. Data is current as of Mar. 30, 2025, and intended for informational purposes only.

Gold’s investment performance does sometimes diverge from that of the S&P 500, especially during economic downturns such as the Great Recession or the COVID-19 pandemic in 2020, when gold rose in price rapidly in response to investor fear.

Gold has also languished for long periods in which the stock market was thriving, as it did for most of the 2010s. But for much of the period shown in the chart above, gold has moved in more or less the same direction as stocks.

Data from the World Gold Council show that the weekly returns of gold have had a low but positive correlation with the weekly returns of the S&P 500 index over the last 25 years, meaning that the two have moved in the same direction most of the time.

The implication is that gold isn’t necessarily a hedge against the stock market, despite its reputation of being precisely this. It’s more of a speculative investment.

In short, there are times, such as right now, when gold looks like a more appealing investment than stocks. Some investment strategists consider it a good way to diversify a portfolio, but the data suggests it’s not a golden ticket to riches.

What’s more, buying gold now means buying at new all-time highs. If you’re investing in gold for the long-term, that may not be a problem. But it’s something short-term traders should keep in mind.

» MORE: 4 ways to invest in gold in 2025

Advertisement

Work on your investment strategy with a financial advisor by your side.

Get matched to a financial advisor for free with NerdWallet Advisor Match. Our matching tool will connect you with a financial advisor that can work with you on your money goals. Whether you're looking to strengthen your investment portfolio, optimize your tax strategy, or plan for retirement, fill out the NerdWallet Advisor Match questionnaire to get an advisor match in minutes. Get matched here.

NerdWallet Advisory is an SEC-registered investment adviser. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators, nor does it indicate a specific level of skill or expertise. NerdWallet Advisory may only conduct business in states where it is registered or qualifies for an exemption or exclusion from registration requirements. Please visit the following links for important disclosures about NerdWallet Advisors Match and/or NerdWallet Planning Powered by Quinn.

Term of the month: Tax-exempt bonds

Depending on how long you’ve waited to file, tax season is either over or in the home stretch. Regardless, if you had an investment-related tax bill to pay from 2024, you may be inspired to explore tax-exempt investments moving forward.

Below, we’re discussing a few types of bond investments whose interest payments are exempt from federal and/or state income tax, and are available in many brokerage accounts.

Note that the tax exemptions below only apply to the income you would receive by holding bonds to maturity. If you sell a bond before maturity, for a higher price than you paid for it, your profit may still be subject to capital gains tax.

» Need to reduce your tax bill now? You can still make tax-deductible IRA contributions for 2024 until Tax Day. Check out our list of the best IRA accounts if you want to open and fund one before the deadline.

Municipal bonds

States, cities, counties and other local governments sometimes issue municipal bonds, or “munis,” to fund public projects such as school and bridge construction.

Interest is exempt from: Federal income tax, and sometimes state income tax as well, depending on where you live and where the bond is from.

Most states don’t tax their own muni bonds, and several have no state income tax at all. In those cases, muni bond interest is completely tax-free. District of Columbia residents also pay no local income taxes on any muni bonds, and all muni bonds from non-state U.S. territories such as Puerto Rico are state-tax-free in all states.

In some cases, however, interest payments on muni bonds that fund business-like enterprises such as stadiums and airports may be subject to the alternative minimum tax (AMT).

Risk level: Medium.

The yields on muni bonds are often higher than the yields on Treasury bonds. But that’s because, unlike the U.S. government, local governments do sometimes default on their debts. The city government of Detroit, for example, defaulted on more than $600 million worth of municipal bonds during its 2013 bankruptcy.

Some muni bonds also have “call risk” (the issuing government may repay the principal of the bond ahead of schedule, causing investors to miss out on some interest payments). Plus, due to their high yields, muni bond prices may fall sharply in response to an increase in interest rates. That’s not an issue if you hold the bonds you buy to maturity, but it’s something to keep in mind.

Available in: Certain brokerage accounts. Some accounts don’t offer individual bonds at all, and others only offer Treasury bonds and corporate bonds. Make sure you research a broker’s investment selections if you’re interested in buying individual muni bonds.

Below is a list of the brokers reviewed by NerdWallet that offer individual muni bonds:

Tax-exempt bond funds

Buying individual muni bonds can be a hassle. One way to simplify the process of adding muni bonds to your portfolio is by investing in a tax-exempt bond fund. These typically invest in muni bonds, and may be available as mutual funds or exchange-traded funds (ETFs).

There are even a few tax-exempt bond funds that invest in munis from a specific state, such as New York, thereby rendering their interest payments exempt from both federal and state taxes for residents of that state.

Interest is exempt from: Federal (and sometimes state) income tax… in theory. Some tax-exempt bond funds advertise themselves as “AMT-free” as well, meaning that they avoid muni bonds that may generate AMT liability.

However, fund managers have a significant amount of discretion over what they invest in, and some tax-exempt bond funds disclaim that they may occasionally invest in assets that do have federal income tax or AMT liability. Make sure you read the fine print before investing.

Risk level: Medium-low.

Funds containing muni bonds deal with the same risks as investors holding individual muni bonds, but a bond fund reduces these risks somewhat for its shareholders by diversifying its investments across many muni bonds.

Available in: Almost all brokerage accounts. Some brokerage accounts don’t offer mutual funds, but tax-exempt bond ETFs can be found wherever ETFs are sold (i.e., in just about any brokerage account).

Treasury bonds, bills and notes

The U.S. government borrows money by issuing Treasury securities of various durations. The term “Treasury bond” is sometimes used to refer specifically to bonds with durations of 20 years or more. Treasury securities with durations of 2 to 10 years are called “notes,” while shorter-duration securities are called “bills.”

Interest is exempt from: State income tax, but not federal income tax.

Risk level: Very low.

The U.S. government is one of the most credible borrowers in the world. It’s not impossible that some cataclysm could cause it to miss payments on Treasuries at some point in the future, but that is so unlikely that it’s generally not worth worrying about.

In recent years, the U.S. government has sometimes had its credit rating downgraded by independent rating agencies, and there have been frequent political fights in Washington over keeping the government funded and raising the debt ceiling. But none of these things have led to a default yet, and the odds of one happening any time in the foreseeable future are still low.

Available in: Most brokerage accounts. Any account that offers individual bonds will offer Treasuries.

» MORE: Best online brokers for bonds

Advertisement

Want an easy, low-risk investment?

The Atomic Treasury account puts your money to work with a competitive yield via T-Bills. Plus, you save on taxes: since interest income from Treasuries is exempt from state and local taxes, you keep more of what you earn. Need access to your cash? No problem. You can access your funds any time.

Dates that could move markets this month

Economic events

Friday, Apr. 4: Bureau of Labor Statistics (BLS) monthly employment report. A report showing hiring levels and various measures of the unemployment rate.

Thursday, Apr. 10: BLS consumer price index (CPI) report. A key inflation gauge. The employment and CPI reports could give investors hints about what the Federal Reserve will do with interest rates in future meetings; unexpectedly high unemployment or low inflation could indicate that rate cuts are on the way.

Friday, Apr. 25: Michigan consumer survey data for April. The University of Michigan will release its preliminary data for this month’s survey on Apr. 11, and its final data on Apr. 25. The survey has become a closely watched indicator of ordinary Americans’ perceptions of the economy.

Wednesday, Apr. 30: Bureau of Economic Analysis first estimate of U.S. gross domestic product (GDP) in Q1 2025. A measurement of whether the economy grew or contracted over the quarter.

Earnings

Below is a table of blue-chip stocks that are reporting earnings in April, with the expected dates and average analyst estimates for their upcoming earnings reports.

We’ve filtered the list for companies with a market capitalization of at least $300 billion. These are high-volume stocks of which earnings reports are often major trading events for options traders and day traders.

Source: Nasdaq.com. Data is current as of Mar. 30, 2025, and intended for informational purposes only.

» See our picks of the best day trading platforms.

More reading on gold, taxes and tech stocks

Neither the author nor editor owned positions in the aforementioned investments at the time of publication.