Harris and Trump's tax plans, explained

Also: blue-chip earnings, key economic data release dates, and what to expect from bank stocks as interest rates fall

In this issue

Experts weigh in on Harris and Trump's tax plans.

Net interest income, and how falling rates affect bank stocks.

Economic data releases, blue chip earnings and more.

What the Harris and Trump tax plans mean for you

About one month from now, voters will decide whether Donald Trump or Kamala Harris will be the next president of the United States. And the election outcome could have big implications for the taxes you pay. Here’s a summary of each candidate’s current tax proposals, along with some expert analyses of what they could mean for the economy and financial markets.

How does Kamala Harris want to change the tax code?

Below is a list of tax policies proposed or endorsed by Kamala Harris or the 2024 Democratic party platform.

Restore the child tax credit to its 2021 levels: $3,000 per child age 6 to 17 or $3,600 per child age 5 and under, up from $2,000 per child now. Raise the credit to $6,000 for infants under 1 year old.

Restore the maximum earned income tax credit for childless taxpayers to its 2021 level of $1,502, up from $632 now.

Provide $25,000 in down payment assistance to homebuyers, potentially in the form of a tax credit. (The 2024 Democratic party platform endorses a first-time homebuyer credit of $15,000.) Create a tax credit for homebuilders to encourage construction.

Create a standard deduction for small businesses, and increase the business deduction for start-up expenses from $5,000 to $50,000.

Increase the corporate tax rate from 21% to 28%.

Increase the top federal income tax rate from 35% to 39.6%.

Increase the top long-term capital gains tax rate from 20% to 28%, and the net investment income tax from 3.8% to 5%.

Tax unrealized capital gains (gains on unsold investments) for taxpayers with total wealth above $100 million.

How does Donald Trump want to change the tax code?

Below is a list of tax policies proposed or endorsed by Donald Trump or the 2024 Republican party platform.

Many of Trump’s tax proposals involve making the 2017 Tax Cuts and Jobs Act (TCJA), which he signed during his first term, permanent. Some provisions of the TCJA are due to expire at the end of 2025, at which point some tax rates would revert back to higher pre-2017 levels.

Eliminate taxes on Social Security benefits.

Lock in the $2,000 child tax credit by making the TCJA, which doubled the credit, permanent. (Republican vice presidential nominee J.D. Vance has proposed increasing the credit to $5,000 per child.)

Lock in the current federal income tax brackets by making the TCJA permanent.

Potentially lower the corporate tax rate to 20% or 15%. (These are isolated comments by Trump and not a specific proposal.)

Create some kind of tax incentive for first-time homebuyers. (The 2024 Republican party platform endorses this, but neither the party nor Trump have proposed specific incentives.)

Lock in the current exclusion amount applicable to estate tax, gift tax and generation-skipping transfer tax by making the TCJA permanent.

Impose a 10% tariff on all imports, and a 60% tariff on Chinese imports, potentially using these tariffs to replace some or all of the personal income tax system. (The 2024 Republican party platform suggests that the tariff system would reduce overall taxation.)

Are there any tax policies that both candidates support?

There is one major change to the tax code that both candidates have voiced support for: eliminating taxes on tips.

Trump first proposed tax-free tips in June during a campaign stop in Nevada, an important toss-up state in the upcoming election. Nevada is home to the highest concentration of tipped workers in the U.S. President Biden endorsed the idea soon after, and Kamala Harris endorsed it as well after taking over as the Democratic nominee.

Mark Luscombe, a certified public accountant (CPA) and the principal federal tax analyst for Wolters Kluwer Tax & Accounting, says that tax-free tips could create some strange incentives.

“People are getting tired of being asked for tips for everything, and this could increase the number of companies that try to push people onto tips, because it saves them money. So at a time when people are opposed to tips, it could increase the move toward tips,” Luscombe says.

“It’s hard to imagine what the effect would be, but it seems to favor a limited segment of the low-income people you’re trying to help,” he adds, noting that many of the lowest-income segments of the service industry, such as fast food workers, do not get tips.

How might the Harris tax plan affect the economy?

An analysis of Harris’ tax plan by the University of Pennsylvania’s Wharton School of Business projects that her plan would increase federal tax revenue by about $1.1 trillion over 10 years.

The Wharton analysis predicts that the plan would increase the annual incomes (after taxes and transfers) of the bottom 90% of earners by about $2,000 by 2034. It would provide a smaller benefit to earners in the 90th to 95th percentiles. The top 5% of earners — especially the top 1% and top 0.1% — would see decreases in their annual income after taxes and transfers.

The effects of a higher child tax credit have been well-studied by economists thanks to the credit’s temporary increase in 2021. A 2023 report by the Brookings Institution found that the increased credit reduced childhood poverty by 44% in 2021. An analysis later in 2023 by the Center for Budget and Policy Priorities found that childhood poverty more than doubled upon the expiration of the increased child tax credit in 2022.

Some of Harris’ corporate and investment tax proposals could weigh on the stock market. Her proposal to tax unrealized gains for taxpayers with wealth above $100 million could weaken the incentive for those taxpayers to hold their investments as long as possible. Luscombe says that could create some “selling pressure” in the stock market, although he notes that such a policy may be challenged in court if implemented.

A higher corporate tax rate may also be bearish for stocks. A 2023 paper by the American Economic Association examined U.S. federal tax changes since World War II and found that “corporate tax increases lead to persistent declines in stock prices.”

Luscombe says that Harris’ proposal to raise the capital gains rate may also create an incentive for some high earners to sell their investments, pay the current rate, and then repurchase them before the higher rate goes into effect, in order to offset the higher rate with a higher cost basis. This could create market volatility in the months before such an increase.

Harris’ homebuyer assistance plan may help some homebuyers, Luscombe says — but it doesn’t necessarily address the affordability problems that come from a constrained supply of housing. But that’s where Harris’ proposed tax credit for homebuilders could come in handy.

“I think creating more supply will help a lot — perhaps more than the $25,000 credit. Because if there’s more supply, that will reduce the pressure on home prices,” Luscombe says.

How might the Trump tax plan affect the economy?

Wharton’s analysis of Trump’s tax plan predicts that it would reduce federal tax revenue by $5.8 trillion over 10 years.

The analysis projects that all earners would see increases in their annual income after taxes and transfers under Trump’s plan, although the bottom 60% of earners would see much smaller increases than under Harris’ plan by 2034. The top 40% of earners would see significant increases in their income after taxes and transfers under Trump’s plan.

The centerpiece of Trump’s tax plan is a 10% baseline tariff on all imported goods. According to Luscombe, history does not support this strategy.

“A lot of times, increased tariffs, if you look back into the 1930s, led to trade wars, which led to recessions and depressions, because all of the countries on which you’re imposing tariffs put up retaliatory tariffs,” Luscombe says.

He notes that companies in certain industries may profit from targeted tariffs. These companies can benefit from protection from foreign competitors that subsidize their export products to make them artificially cheap, as China has done with steel. However, targeted tariffs are different from the baseline tariffs Trump is proposing; Biden has also raised targeted tariffs on Chinese steel.

The Tax Foundation projects that Trump’s proposal for a 10% baseline tariff and a 60% tariff on China would cancel out a significant portion of the economic growth from Trump’s other tax proposals. If other countries retaliate with their own tariffs, the Tax Foundation projects that this would cancel out all of the Trump plan’s economic gains.

Luscombe says that the idea of replacing personal income taxes with tariffs is especially impractical.

“Most people think that would be an utter disaster; you couldn’t raise enough tariff money to replace the income tax in any practical way,” he says.

Regardless of who wins the election, the tax code is likely to see some changes over the next presidential term. A Harris victory might mean increases in certain rates. A Trump victory might preserve the current TCJA rates, but it could also bring paradigm-shifting tariffs.

» Estimate your tax liability with our income tax calculator.

Term of the month: Net interest income (NII)

In last month’s issue, we asked experts what falling interest rates could mean for your bank account — in particular, how they might affect the yields on savings accounts and certificates of deposit (CDs).

But how do they affect banks themselves? That’s a timely question, given that October is a big month for bank stocks. Ten of the world’s largest banks will report quarterly earnings over the next few weeks.

Below is a table of upcoming earnings reports from banks with market capitalizations of at least $100 billion:

Source: Nasdaq.com. Data is current as of Sep. 25, 2024 and intended for informational purposes only.

The effects of falling interest rates on banks are complex. To understand them, we need to get familiar with a somewhat-obscure accounting term: net interest income (NII).

What is net interest income?

Net interest income is the difference between a bank’s lending revenues (such as credit card interest) and its borrowing expenses (such as the interest it pays on savings accounts).

NII is a key measure of profitability for banks, and is one of the biggest line items in the calculation of a bank’s earnings per share (EPS).

How do falling interest rates affect NII and bank earnings?

The answer isn’t always clear. As we noted in our last issue, falling rates could potentially benefit some banks if there is a lag between decreases in their borrowing costs and decreases in their lending revenue.

However, some research suggests that falling rates decrease banks’ NII, as lower rates mean lower potential spreads between interest revenue and interest expenses. For example, a 2023 paper by the Reserve Bank of Australia looked at banking data from multiple countries between 1999 and 2019, and found that “declining interest rates reduce banks’ net interest margins.”

We asked two former bank inspectors how falling interest rates can affect banks, and got two very different answers.

“Falling rates may result in lower earnings for a time,” Ross Meredith, a former bank inspector for the Federal Deposit Insurance Corporation (FDIC) and a director of the BetterInvesting network of investment clubs, said in an email interview.

However, Joe Farrell, another retired bank inspector and BetterInvesting director, expressed the opposite view. “It is my belief that falling interest rates do benefit most banks,” Farrell said in an email interview.

Meredith and Farrell both noted that the effect on a particular bank will depend on that bank’s mix of assets and liabilities.

A bank that holds a lot of variable-rate assets (such as floating-rate bonds) and has a lot of fixed-rate liabilities (such as customers with fixed-rate CDs) will generally be hurt by a decrease in interest rates, as the rates on variable-rate products tend to change more quickly than fixed-rate products. Conversely, a bank that holds a lot of fixed-rate assets and a lot of variable-rate liabilities will generally be helped by a decrease in rates.

» Check out some of the best-performing bond ETFs.

What do falling rates mean for bank stocks?

Although Meredith and Farrell had different big-picture perspectives on what falling rates mean for banks, they generally agreed about how the Federal Reserve’s recent cut will affect bank stocks over the next few months: mostly negatively.

“I expect virtually no impact on third quarter results and a modest, muted negative impact on bank earnings in the 4th quarter. Subsequent quarters will see a gradual recovery of any small negative impact seen in the 4th quarter,” Meredith said.

Farrell had a similar short-term outlook on bank stocks, but for different reasons. “Since the Fed dropped rates only recently, we should see practically no effect on quarterly earnings. However, bank stock prices may be adversely affected by the unrealistic perception that a small drop in rates will cause large declines in earnings per share in [the fourth quarter of 2024],” he said.

So the Fed’s recent cut is unlikely to move the needle in the upcoming bank earnings season — but it could create some opportunities to buy the dip in bank stocks in the quarters ahead.

» Take a look at the best brokerage accounts for stock trading.

Dates that could move markets this month

Economic events

Friday, Oct. 4: Bureau of Labor Statistics monthly employment report. A report showing hiring levels and various measures of the unemployment rate.

Thursday, Oct. 10: BLS consumer price index (CPI) report. A key inflation gauge. The employment and CPI reports could give investors hints about what the Federal Reserve will do with interest rates in future meetings; unexpectedly high unemployment or low inflation could indicate that rate cuts are on the way.

Friday, Oct. 25: Michigan Consumer Survey data for October. The University of Michigan will release its final data for last month’s survey on Oct. 11, and its preliminary data for this month’s survey on Oct. 25. The survey has become a closely watched indicator of ordinary Americans’ perceptions of the economy.

Wednesday, Oct. 30: Bureau of Economic Analysis first estimate of U.S. gross domestic product (GDP) in Q3 2024. A measurement of whether the economy grew or contracted over the quarter.

Earnings

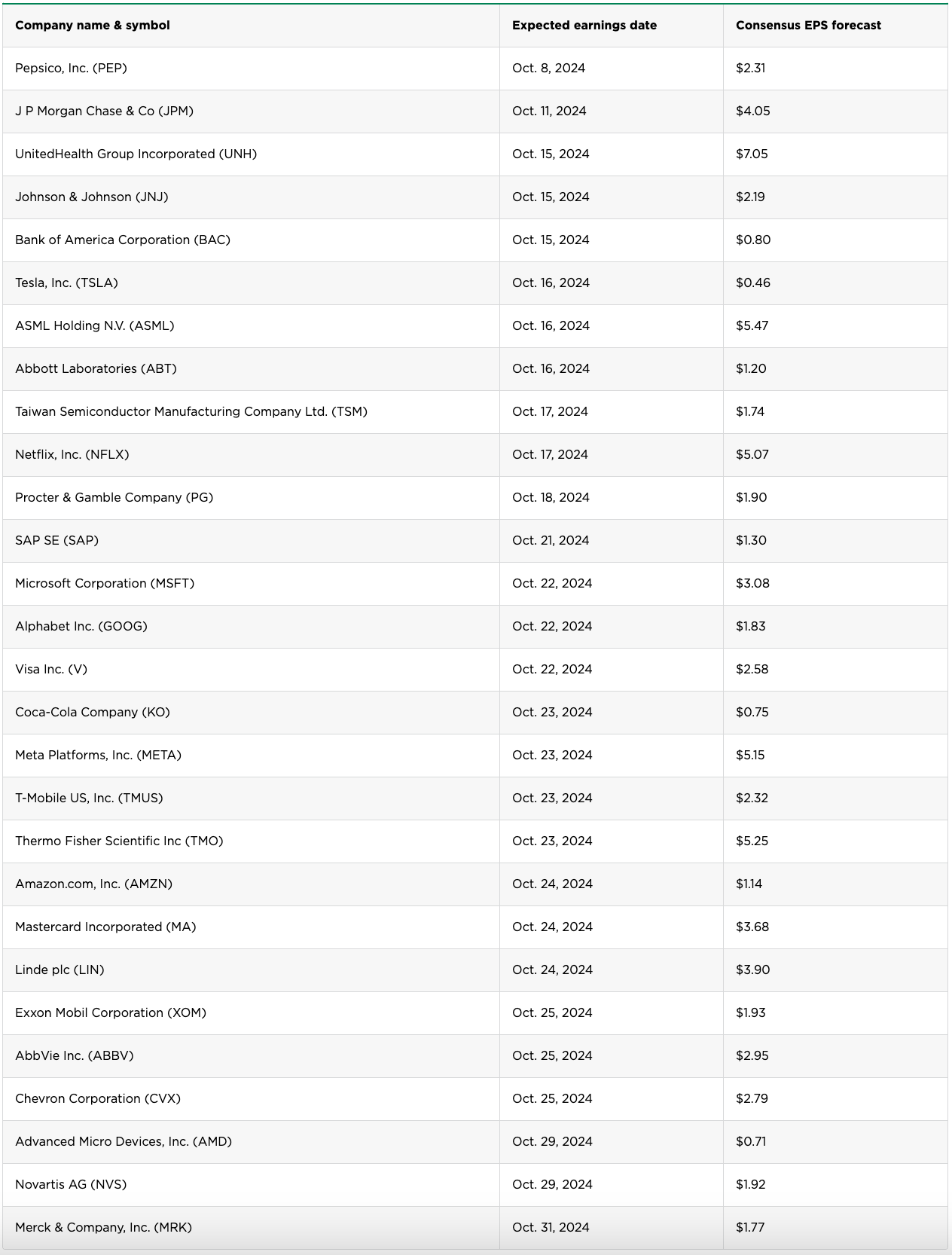

Below is a table of blue-chip stocks that are reporting earnings in October, with the expected dates and average analyst estimates for their upcoming earnings reports.

We’ve filtered the list for companies with a market capitalization of at least $200 billion. These are high-volume stocks whose earnings reports are often major trading events for options traders and day traders.

Source: Nasdaq.com. Data is current as of Sep. 27, 2024 and intended for informational purposes only.

» Want to start trading options? See our picks of the best options trading brokers.

Neither the author nor editor owned positions in the aforementioned investments at the time of publication.